Overview

Is your credit score terrible, feeling rejected by most banks? But, still, you need to pay for that costly car repair.

Fortunately enough, there are online marketplaces that can lead you to a network of legit lenders and help you in no time, like CashAdvance.com.

Stay with us and discover what we have to say in this CashAdvace.com review. Here’s a rundown of everything we’ll talk about.

Contents:

- Overview

- Highlights

- Requirements

- Loan Terms

- How to Apply For A Loan With CashAdvance.com?

- What Is Credit Scores Ranges CashAdvance.com Good For?

- CashAdvance.com Ratings and Accreditation

- CashAdvance.com Customer Reviews

- Pros and Cons

- Customer Support Service

- CashAdvance.com Alternatives

- CashAdvance.com vs. Earnin

- CashAdvance.com vs. Ace Cash Express

- Conclusion

- FAQs

What is CashAdvance.com?

CashAdvance.com is an online marketplace whose goal is to enable borrowers to connect with lenders. You can acquire money immediately, even if you have bad credit. However, because lenders only provide short-term high-interest loans, they must pay them back quickly.

Being a member of the Online Lenders Alliance (OLA), CashAdvance.com abides by all best practices for the online lending industry.

What type of loan services does CashAdvance.com provide?

The name pretty much covers the whole idea behind this platform. CashAdvance.com means you take cash in advance. The loans offered are short-term loans and entirely online. The minimum loan request is no less than $100, while the maximum money you can ask for is $999.

Hence, more or less, you need to pay back what you borrowed in a specific time frame. However, bear in mind that this kind of service typically comes with a high interest rate.

How big is their network?

CashAdvance.com has a significantly large network. Moreover, they cooperate with third-party lenders to give their clients the more choice possible and more opportunities to fulfill their financial needs. The following are some of the big names or their third-party partner lenders:

- Lexington Law.

- Credit.com.

- OneMain Financial Group, LLC.

- OneMain Consumer Loan, Inc.

Who can use their service?

CashAdvance.com is recommendable primarily for people who need urgent cash. Although, people with bad credit could benefit quite a lot from this kind of service too. But, as we just mentioned, you need to be aware that this kind of quick and easy cash service comes with a costly interest rate.

CashAdvance.com Highlights

So far, during our in-depth research for this CashAdvance.com review, we discovered several unique features of the service. Let us share them with you, as follows:

- Firstly, CashAdvance is not a lender itself. Instead, it connects several lending agencies or independent lenders with borrowers in need of cash. Therefore, the conditions around loans can vary significantly. All loans are given short-term, and you don’t have options for long-term financing.

- The lending partner networks don’t require a minimum credit score. Therefore, people with bad credit can easily acquire the money they need immediately. Moreover, you can also get money within one business day, making the lending process extremely convenient.

- However, the interest rates for your lent money can be significantly high, precisely because of the short term offered for paying back the same. In some cases, the interest rate can easily surpass three times the amount you initially borrowed if you don’t pay up immediately.

- The repayment method can vary according to your given lender. However, you must repay your lender within one year. Typically, the size of your loan can range from $100 to $1000, where the loan term is between seven and sixty days.

- The most significant disadvantage of CashAdvance.com is the incredibly high APR range, which starts from a good 15 percent to a ridiculous rate of 1,564 percent.

Visiting their website, we found that it is similar to most leading online lending networks. It boasts an extensive network of lenders and gives you lengthy detail regarding the platform’s role in the lending process.

And what’s good about all of it is that you can begin your loan application directly from their homepage. The only thing required from you is to input your birth year, ZIP Code, as well as the last four digits of your social security number. Once this is filled in, your form will be ready for processing.

Stay with us because as we advance into our CashAdvance com review, we will discuss other aspects of the service in detail.

CashAdvance.com Requirements

CashAdvance.com enlists pretty specific requirements for borrowers seeking fast short-term loans.

First and foremost, the borrower must be at least 18 years of age and legally a US citizen.

Aside from that, he or she must have a job and an after-tax monthly income of $1.000.

Of course, CashAdvance.com requires your permission to verify your employment.

At the same time, you must provide the service a valid checking account for processing all your payments.

Lastly, you must give the platform essential details such as your home address, telephone number, and email address. You must ensure that all these details are valid and connected to yourself.

The vast majority of legitimate cash advance providers make it mandatory for borrowers to surpass a credit score for their application. Comparatively, requirements for CashAdvance.com are not strict. Most importantly, the platform doesn’t charge you anything for processing your loan application.

NB: Short-term loans need to be paid back before your next payday.

As far as the APR goes, CashAdvance.com is not determining the fees; this is between you and your lender.

CashAdvance.com Loan Terms

Cash Advance lenders can offer varying loan terms to borrowers. Some borrowers make it mandatory to pay within a couple of months, whereas others allow borrowers to pay within five to six months.

Regardless, all borrowers must pay their respective amounts within one year. Considering the high-interest rates of the loan term, most customers prefer returning the amount immediately and prevent the interest rate from piling up.

Before you apply for your loan, it’s essential to look up your credit score. Although you can still receive loans despite having bad credit, remember: the higher your credit score, the lesser the interest rate you must pay. So, it’s always best to check all your options before going in with a particular lender.

How To Apply For a CashAdvance.com Loan?

CashAdvance.com quickly processes your applications, enabling you to get cash in hand within one business day. Once a lender accepts your application, the platform will transfer your amount directly into your bank account.

You can apply for the loan application in three simple steps:

Step 1: Customers need a cash advance loan to start their application by submitting an online request.

They must fill in all necessary details to find potential loan providers from its extensive network of cash advance lenders. Once you fill in all the necessary information in the form, click ‘get started’ to begin your application.

Step 2: After the initial form, the website will request you to fill another form called the loan offer request form.

The form will contain some personal and financial questions, which will ask about the amount you want to borrow and how much money you earn.

Step 3: All you must do now is apply online after completing the form. Your lender will then email you a bunch of loan offers.

Remember that you are at your discretion to choose the loan offer that fits you. If you don’t like the loan offer, you don’t have to pursue it, and the platform will not charge you any fees.

Is My Personal Data Safe?

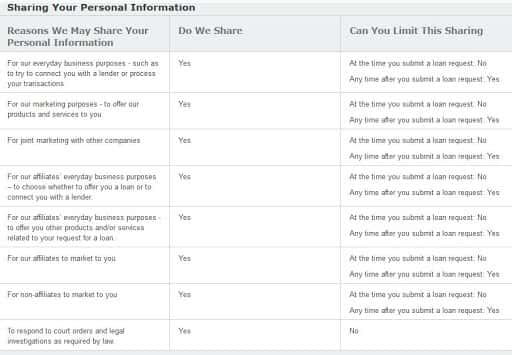

CashAdvance.com respects and takes into consideration the data you leave with them. They have a specific privacy policy that is available to all who visit the site.

It is clearly stated that the companies decide how they will share their data. As far as the consumers go, they have enabled the right to decide which info should be disclosed.

Still, it is crucial for you as their customers to understand that at a certain point, some of your personal information (name, birth date, age, social security number, employment info, etc.) have to be shared for you to be paired with a lender service.

However, even though this information is shared, they aren’t just given away to be taken advantage of. CashAdvance.com also signs an agreement with the site shared for this data to stay well protected and private.

In addition to this, here is more information on how CashAdvance.com shares your personal information:

(The screenshot is taken from CashAdvance.com official website)

Who Is It CashAdvance.com Best For?

Cash advance bad credit leniency makes things great for borrowers who don’t have good credit scores. The platform allows you to get a personal cash advance without enforcing strict requirements. And as we already mentioned, people who need cash on the same or the next day of their application can benefit from the cash advance loans. Usually, borrowers choose these loans when they don’t have any other financing options.

What Is Credit Scores Ranges CashAdvance.com Good For?

Since you can encounter different lenders at any given time, the availability of the service can change based on your location or the type of loan you are seeking. That said, CashAdvance.com offers its services across 38 out of 50 states.

You can acquire loans from CashAdvance.com huge network of lenders if you are in the following states:

| Alabama | Illinois | Mississippi | Ohio | Utah |

| Alaska | Indiana | Missouri | Oklahoma | Virginia |

| California | Iowa | Montana | Oregon | Washington |

| Colorado | Kansas | Nebraska | Rhode Island | West Virginia |

| Delaware | Kentucky | Nevada | South Carolina | Wisconsin |

| Florida | Louisiana | New Mexico | South Dakota | Wyoming |

| Hawaii | Michigan | New York | Tennessee | |

| Idaho | Minnesota | North Dakota | Texas |

CashAdvance.com Customer Ratings and Accreditation

With no further ado, let us see how well or not that well is CashAdvance.com doing on some of the most reputable rating sites.

BBB (the Better Business Bureau): We stumbled upon a BBB profile of CashAdvance.com, however strange enough, without any CashAdvance.com customer reviews. But, we did see that the BBB has given them an A+ grade rating, though CashAdvance.com doesn’t have a BBB accreditation. However, since CashAdvance.com relies on a network of independent lenders, it’s hard to gauge the service through BBB ratings.

Trustpilot: CashAdvance.com received a 3.5 star-rating/5 based on 0 customer reviews. Shocking, yes. However, we are aware that Trustpilot enables companies to remove the customer reviews; supposedly, they did in this case.

ConsumerAffairs: To our great surprise, there are no CashAdvance.com customer reviews or ratings for that matter on this prominent rating website. We did not see that coming.

CashAdvance.com Customer Reviews

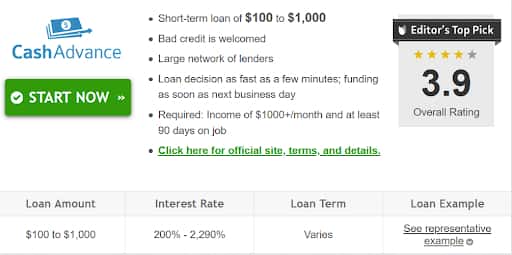

Similar to many other online loan marketplaces, CashAdvance.com hasn’t gathered many reviews recently. However, Badcredits.org enlists CashAdvance.com as a fairly decent short-term lending platform with a 3.9 rating out of 5. It also rates CashAdvance.com as the second-best option amongst no credit check loaning services.

As with all online financial marketplaces, you must do some deep research and go through as many online loan service reviews as possible before going any further, like applying for one.

Therefore, if you receive a loan offer from a lender in the CashAdvance.com network, make sure you understand all the terms and conditions before moving forward.

CashAdvance.com Pros and Cons

Pros

- It doesn’t matter if you have a cash advance bad credit score.

- Convenient.

- Personal cash advance within one day.

- Free to use.

Cons

- Employment required.

- High-interest rates.

- Limited loan amount.

Customer Support Service

Upon visiting the contact page, you will find a contact form. Feel free to use it and thus make direct contact with the company.

You can also visit their office anytime between 6 AM and 7 PM on business days at the following address, 12850 West 331 North Suite 60, Altamont, UT 84401.

Besides that, you can also reach them via email: [email protected].

And if that isn’t enough, you can contact CashAdvance.com phone number 1-800-380-2274 for an instant chat on their lending policies and rules.

Apart from all these quick and practical ways of getting in touch with them, CashAdvance.com has come up with a nicely put-together FAQs section too. You can look at it before you go on and contact them through any of the other ways mentioned above.

CashAdvance.com Alternatives

CashAdvance.com vs. Earnin

Earnin is a payday lending service that allows you to receive amounts from $100 to $500 before your payday, opposed to CashAdvance.com’s maximum of $999.

If you decide to borrow money from Earnin, you should know that the service auto-deducts the liable amount from your checking account once you receive your payment. Whereas, with CashAdvance.com, you can pay back the borrowed money before your next payday arrives.

Both Earnin and CashAdvance.com won’t charge you anything for the service they will provide you with. In addition to this, Earnin doesn’t even charge you interest or overdraft fees. That said, you must ensure that at least half of your paycheck is auto-deposited into your checking account every month. However, same as with CashAdvance.com, you must provide Earnin your bank account details also.

CashAdvance.com vs. Ace Cash Express

Ace Cash Express, same as CashAdvance.com, is here to give you a hand when in need of a fast loan or if you are facing a bad credit score.

But, unlike CashAdvance.com, this loan service will deny their service to you if you have filed for bankruptcy or intend to do that soon. Another significant difference between these two online loan services is the maximum amount you can borrow through them.

While CashAdvance.com offers a maximum of $999, no matter your ZIP code, Ace Cash Express determines the maximum loan amount according to the state you live in. Therefore, our advice would be to check their website or get in touch with them and find out more on this matter before you apply for a loan with them.

In the end, both of these services come with some costly high interest rates; nevertheless, this is to be expected with most of these kinds of services.

Conclusion

We discovered that CashAdvance.com is a reliable and convenient service for acquiring quick and hassle-free loans, regardless of your credit score. They offer a great platform to connect you with lenders willing to offer their services to you.

That said, before you go into any plan, you should consider the short repayment period and high-interest rates before making up your mind.

We hope this CashAdvance.com review is of great use to you and will help you easily decide whether you’d want to go and get financial help from these guys or somewhere else.

FAQ

1. Is CashAdvance.com legit?

Undoubtedly, CashAdvance.com is a legitimate lending platform where lenders and borrowers can meet. Although the interest rates of some lenders can be insanely high and comparable with title loan and payday loan companies, this theme is common in companies that offer services to borrowers with poor credit. Don’t forget that they are also part of the OLA (Online Lenders Alliance).

2. What are the best cash advance apps?

Here is a list of some of the best cash advance apps you can find today to help you out when in need of fast money loan:

- Wealthfront Cash Account

- Chime

- Empower

- Axos Bank

- Earnin