Personal finance software programs are a dime a dozen, and with the market saturated, it can be hard to find one that is right for your business and personal finance needs. However, one software that caught our eye and the attention of millions of users is AceMoney.

If you have been looking for a detailed AceMoney review, you have come to the right place. We will share all the details, features, pricing plans, pros and cons, and FAQs related to the software right here.

Contents:

- AceMoney Overview

- What Is AceMoney?

- What Is AceMoney Best for?

- How Big Is Their Network?

- Is It the Right Software for You?

- How Secure Is AceMoney?

- AceMoney Highlights

- Can We Do Any Business with AceMoney?

- What Operating Systems Does AceMoney Support?

- Does It Have Any App (does it support Android and iOS)?

- Type of Software – Standalone or Web-Based

- Is It Available in Different Languages?

- How the Better Business Bureau (BBB) Rates AceMoney?

- What Are the Features of AceMoney?

- Manage Multiple Accounts

- Create and Manage Budget Reports

- Spending Tracking

- Track the Investments

- Data Import/Export

- Bill Payments

- Ace Currency Exchange

- E-Business

- Types of Business It Supports

- Online Banking

- AceMoney Pricing Details

- What Are the Plans Available?

- Any Subscription Fees?

- Is There a Free Trial?

- Any Plan Debts and Mortgage Payments?

- The Working Procedure of AceMoney

- How Does AceMoney Work?

- Is AceMoney Eligible for Any Software License?

- What Do AceMoney and AceMoney Lite Have in Common?

- Alternatives of AceMoney

- AceMoney vs. Quicken

- AceMoney vs. MoneyDance

- AceMoney vs. Pocketsmith

- AceMoney vs. DollarBird

- AceMoney vs. HomeBudget

- AceMoney Pros and Cons

- AceMoney Customer Reviews

- Conclusion

- FAQs

AceMoney Overview

AceMoney is a personal finance software designed by MechCAD Software which isn’t complex to use.

Who is MechCAD Software?

MechCAD is a Florida-based software company founded in 2003, dedicated to developing high-tech and affordable personal finance software.

Numerous customer reviews claim AceMoney to be the most valuable and practical choice to go with since it ranges among software like Microsoft Money or Quicken. In addition to this, worthy of mentioning is that AceMoney has been voted out as THE best alternative for the already mentioned Microsoft Money and Quicken finance software.

Though AceMoney may not be the most polished software out there, it is efficient in helping budget and tracking financial accounts.

Stay with us and learn more about it in our AceMoney review right here.

What Is AceMoney?

AceMoney from MechCAD follows the familiar MS Money and Quicken pattern and is a personal finance management software. You can view your stock, bank, and credit card transactions with the program and get a clear view of your financial health in complete detail.

What Is AceMoney Best for?

Like most personal finance software programs, it allows you to manage your financial data and run fiscal reports. It produces pie charts and diagrams and lets you create budget limits for guiding your saving and spending activities. Moreover, AceMoney can transfer your data from other similar software too. And it also comes with an ‘overview’ option, so you will be able to view all of the money you have: pending bills, expenses, personal accounts, investments you’ve made, etc.

How Big Is Their Network?

AceMoney doesn’t have the most extensive network because you can’t enter any bank transactions or details automatically. Thus, you will need to download files and enter them into the software before you start budgeting, track spending, setting goals, and accounting for your financial needs.

Is It the Right Software for You?

It’s not easy to give a straight answer to a question like this one since not everyone has the same expectations. However, it’s safe to say that AceMoney covers the personal financial management basics exceptionally well, but it doesn’t do much more than that. You can take advantage of helpful savings, loan, and mortgage calculators built into the software, but they won’t import data automatically from your financial transactions.

How Secure Is AceMoney?

AceMoney is secured by SSL technology that encrypts data and is a strong package because you won’t need to enter any bank account details into the software. Unfortunately, it doesn’t have any features for password protection, so you should be careful when using the program.

AceMoney Highlights

For you to have the complete picture, we went on to share our top highlights of the AceMoney personal finance software program and everything you need to know before using it.

Can We Do Any Business with AceMoney?

As we just mentioned, the one thing that works quite in favor of AceMoney is that it is extremely simple to use and covers the basics incredibly well. Therefore, if you have a simple business setup and want to budget your spending, savings, and expenses, you can use the software to your benefit.

What Operating Systems Does AceMoney Support?

AceMoney only supports Windows operating systems or Mac OS X. Therefore, if you were thinking about using it for multiple operating systems, you would be disappointed in its limited potential.

Does It Have Any App (does it support Android and iOS)?

Unfortunately, this is the one area where the AceMoney personal finance software program is lacking. It doesn’t have any mobile app and doesn’t support Android or iOS. However, you’d be happy to hear that AceMoney is working on enabling this software to be used on Android and iOS devices. Be following any news and announcements on their official website and stay up to date with AceMoney novelties.

Type of Software – Standalone or Web-Based

The good news for AceMoney personal finance software users is that it is a standalone program, and you can use it without having any accounting or bookkeeping knowledge.

Is It Available in Different Languages?

Yes, AceMoney can praise itself with the availability of more than twenty-five languages, so you won’t have any problems managing the system and software of this program. There is even an option to add your language.

How the Better Business Bureau (BBB) Rates AceMoney?

The Better Business Bureau (BBB) has given AceMoney a B- rating so far. Even though it is not an A grade, it shows how impressive the software program has been in helping people manage their finances and budgets. On the other hand, aside from the rating, AceMoney hasn’t been accredited by the BBB, at least not yet.

What Are the Features of AceMoney?

Now that we have shared the overview and highlights of AceMoney, let us look at the features of AceMoney in greater detail. They are as follows:

Manage Multiple Accounts

One of the defining features of this personal finance software is that it supports different types of accounts. Additionally, it also allows you to support a custom account of your own—You can manage accounts such as debt, loans, credit cards, savings, and checking accounts.

Create and Manage Budget Reports

For those being worried whether they’ll find their way when it comes to creating and managing budget reports – worry no more! It has never been easier or simpler to be done, as with AceMoney. It has more than 100 spending and budgeting categories, so you can configure the budget limits for each category and track the differences between budgeted and actual values.

Spending Tracking

Can’t keep track of how much you’re spending? That will be a problem for the past because AceMoney allows you to easily keep tabs on your spending.

You can track the amounts you have spent and view your overall expenses and expenditure from the program. For instance, you may wonder how much you’ve spent in a year somewhere, like your favorite coffee shop. You could quickly do this with AceMoney’s software.

If you opt to go for that end-year check-up at specific spending categories, just remember that ‘payee’ is the one/the side that receives what you’re paying/spending on. While, ‘payor’ is your employer, the side from which you are receiving the money to your AceMoney.

Track Investments

You can track all your investment activities with greater ease, such as employee stock purchase plans, 401k, or stock options.

This software goes as far as giving you a full list of the total worth and the all-in-all loss or earnings. The best part is that it will download all stock quotes automatically from the internet, and you can track your investments.

Data Import/Export

AceMoney makes transferring all your data from your transactions over the years to be done as 1, 2, 3. In other words, it allows you to import your data from any personal finance software in QFX and QIF formats.

Bill Payments

You will never be late for any bill payments again because AceMoney will alert you whenever your bills are due, and you can easily make your payments on time. How great is that?!

Ace Currency Exchange

You won’t have any problems with currency exchange because AceMoney offers you exchange rates for more than a hundred and fifty various currencies, which will be downloaded automatically from the internet.

E-Business

Managing, tracking, budgeting, and reporting the personal finances of your E-business will be effortless and straightforward with AceMoney. Since this is what they do for you— they make sure you don’t have to worry about a secondary program for the same thing.

Types of Business It Supports

As we’ve mentioned briefly earlier, AceMoney is ideal for beginners and small and simple businesses that don’t have an extensive list of bank transactions. This personal finance software as such supports small businesses and has proven to be a gamechanger for them.

Online Banking

AceMoney makes online banking undemanding and much easier than you’ve imagined. Since all your personal and banking transactions are categorized automatically by the program itself, you have nothing to worry about. This way, things are made easy because it helps show where you spent your money and generate budget reports easily through the same categories.

AceMoney Pricing Details

Now let’s take a look at their pricing structure for those who opt to purchase and download the AceMoney personal finance software program.

What Are the Plans Available?

There are two versions of the software, AceMoney and AceMoney Lite. As far as the versions go, they do have differences. Stay with us and read about it a bit later in this review.

AceMoney has a one-time accurate budget-affordable purchase fee of no more than $44.95. With the purchase, you are entitled to and assured to get all future updates for free. Consequently, you won’t need to buy the product all over again to avail of future updates.

However, there is one more plan related to their technical support – a 2-Year Support Plan. This plan goes for $19.25 exactly. You secure yourself with a two-year plan (right after the first two expire) by purchasing it. This support plan is made to help you and protect you. Here’s what it includes:

– recovery of license (in case it’s lost)

– recovery of data (in case of a forgotten password on certain protected files you have, or corrupted files, maybe)

You can either pay with crypto or any credit card for the products offered.

Any Subscription Fees?

There is no subscription fee with AceMoney. You buy it once and then get to use the software program for the foreseeable future. That makes it convenient for people who don’t want to go through the hassle of signing up for the program multiple times.

Is There a Free Trial?

Yes, you do get a fifteen-day money-back free trial with AceMoney. You can test the personal finance software and see whether it is suitable for your business.

Any Plan Debts and Mortgage Payments?

There are no plan debts and mortgage payments with AceMoney. The low-cost fee for downloading the program is all that you have to pay to use it.

The Working Procedure of AceMoney

AceMoney has a relatively simple working procedure, which we will explain in detail below.

How Does AceMoney Work?

Let’s go through this step by step:

Step 1: First things first, before you start using AceMoney, the program itself will offer you a sample to follow. Our suggestion to you is to accept and see it before doing anything else.

Step 2: Now that you have seen the sample and know what and how you need to do things, set up the multiple accounts you want to manage with the software program.

Start by setting up a credit card, debit, loans, savings, and checking accounts. These will make up the basis of your management program for personal finances. Feel free to create a custom account type if you need one too.

Step 3: After the accounts setup is done, the software needs to be configured so as to download transactions automatically into AceMoney, and link with your bank accounts directly.

Once that is done, you can then start categorizing them, and the balance will be updated depending on the amount of money you have spent.

It’s the system’s job to remember payees that enter frequent, regular categories and transactions, making it easier for you to add more transactions and keep them all organized.

Step 4: You need to set up your budget. The budget tool is integrated into the category list—where you can manage your budget plan.

Step 5: Once you have set up your budget, you can select from more than 100 different categories, which have been pre-set for expenses that range from clothes to rent, and from entertainment to food.

Step 6: After entering the spending against the categories, you will be shown the projected spending limits you have against your current financial accounts.

You can also use the reporting feature in AceMoney and create simple reports to find out where your money is spent and configure the reports by categories. You can also select reports such as cash flow, net worth, and spending divided by date or category. In other words, you can configure all the parameters and view the reports in bar charts or regular charts.

Is AceMoney Eligible for Any Software License?

There isn’t any software license that is eligible for AceMoney, which is a shame because the personal finance management program is excellent for budgeting and money management. However, that doesn’t mean it isn’t practical, and even without a software license, it can be beneficial.

With that being said, there is still a license, but it’s an electronic one. This is actually what you get once you purchase the AceMoney software. By obtaining this license, you will be able to pursue the free trial version and with it unlock everything AceMoney has to offer – including access to all of the updates that will take place.

AceMoney and AceMoney Lite

What Do AceMoney and AceMoney Lite Have in Common?

AceMoney and AceMoney Lite are virtually the same, with the only difference between both versions being the number of accounts it can support. Otherwise, both versions have the same interface, file format, forms, and dialogs.

The full version of AceMoney offers support for unlimited accounts, while AceMoney Lite can only support 2 accounts.

Since every account has its currency, you can maintain a record of transactions between both accounts. Let’s say that you own credit and a checking account. Therefore, you can keep track of transfers between these two, i.e.; you can mark every single time you’ve paid for the credit card with a check.

AceMoney Alternatives

Numerous personal finance software programs in the market can serve as an alternative to AceMoney. Here are our top 5 choices, for that matter.

AceMoney vs. Quicken

Quicken can be labeled as an alternative to AceMoney and vice versa. It starts with a lower price than AceMoney, but it offers more advanced plans with higher pricing.

Another difference would be the trial period both of the software offers: Quicken offers thirty days free of charge, opposed to the fifteen-day trial period by AceMoney. However, if you want easier integration and import/export documents, Quicken is the way to go. Whereas, for those who want basic financial management and budgeting, then AceMoney remains the better alternative.

AceMoney vs. Moneydance

Both Moneydance and AceMoney offer the same level of features, apart from the online banking feature. This is where Moneydance takes over the lead, providing users with online payment sending from a large number of financial institutions. Also, Moneydance is the more expensive software of the two.

Not to worry though, since both of the software guarantees to return your money. So, if you’re looking to save money, you will opt for AceMoney every time.

AceMoney vs. PocketSmith

AceMoney and PocketSmith do have similarities, as well as differences. We can’t ignore the fact that PocketSmith comes equipped with more features than AceMoney. They both offer the most basic financial budgeting tools to keep track of your losses and earnings.

PocketSmith does come with a unique feature where you could keep track of your Airbnb gains and expenditures (this will probably come in handy if you are advertising your flat on Airbnb). PocketSmith also enables you to forecast your money and run scenarios for projecting future finance balances, which you won’t get if using AceMoney.

While AceMoney offers two versions of their product, PocketSmith also offers a free version with the most basic features. However, you still need to input your banking information manually.

Another great difference is the one in price. You only pay once for AceMoney, while for PocketSmith, you pay a monthly fee of $9.95.

AceMoney vs. Dollarbird

Unlike AceMoney, Dollarbird is available on Android and iOS devices. Same as the previous comparison, these two have their similarities and differences when discussing the availability of features. But in the end, they both help you keep track of gains and losses and manage your budget in an effortless and straightforward kind of way.

Dollarbird offers a five-year financial plan, which helps you set your financial goals. You will also be alerted about any upcoming bills you haven’t paid yet, just as if you are using AceMoney.

Dollarbird offers only monthly subscriptions in terms of price, whereas, with AceMoney, you only pay once.

AceMoney vs. HomeBudget

HomeBudget is an excellent choice as an alternative to AceMoney. With that being said, they both offer the same valuable features, more or less.

However, AceMoney is only available on the web (for now), while HomeBudget can be acquired for $4.99 on iOS and $5.99 on Android devices. Their mobile application has an excellent interface that is easy to read, clean, and color-coded. You can view your expenses, bills, accounts, budgets, and income when you link your accounts.

Finally, suppose we were to compare their prices. In that case, HomeBudget offers monthly subscriptions that will turn out more expensive, while as already known, AceMoney takes your money only once.

AceMoney Pros and Cons

As with any software, this one has some pros and cons related to it. To get the complete picture of whether you should use the AceMoney software, we have shared the following:

Pros:

- Spam-free

- Small footprint

- Great at transaction cleanup

- Easy to use

- Manage multiple accounts

- Multiple currencies

- Decent range of reports

Cons:

- No mobile app

- Limited customer support

- Can’t pay bills online

- No automatic bank downloads

AceMoney Customer Reviews

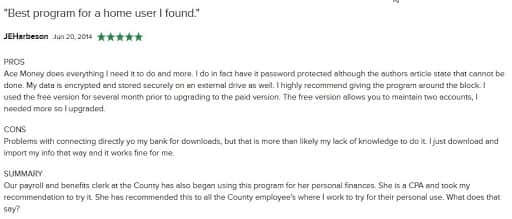

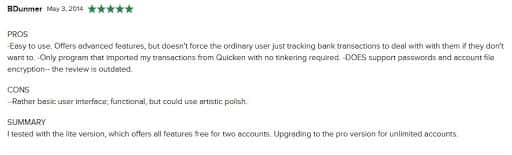

Are you ready to hear more about this affordable personal finance software? We dedicate this section to AceMoney’s reviews from verified customers. Let’s see some positive and less positive (negative) reviews.

Positive Customer Reviews

(The Screenshots are taken from review sites)

Negative Customer Reviews

(The screenshots are taken from review sites)

As you can read for yourself, while others are highly dissatisfied, others are beyond happy with it. Or take it this way; these are personal opinions and individual experiences. Doesn’t necessarily mean that it won’t work for you or vice versa.

Conclusion

To conclude, AceMoney is a personal finance software that could help you manage all your expenses and earnings in one place.

The best of all is that you don’t have to be tech-wise to understand its features. It comes with a straightforward and easy to go by interface. One of its best perks is that you only pay once, and you are guaranteed lifetime usage with all present and future updates.

Bottom line, if you are struggling with your finances or simply wonder where every penny goes, make this purchase and wonder no more. We hope to answer your questions and clear any doubts you had before this AceMoney review.

FAQ

1. Can I Import Information by Linking to the Bank Account?

Yes, you can, provided that the bank you are banking with supports Direct Connect—it is the OXF protocol that makes it possible for these downloads and transactions to happen. It is supported by more than 4.000 banks, which allows AceMoney to connect to any bank and import information. Or, at the very least, you can sign in on your bank’s website and download the transactions in .qif or .ofx formats so that AceMoney can import them with ease.

2.Which Transaction Data Can Be Amended?

You can amend any transaction data that has been recorded and filed in the final stage. Using AceMoney, you can make changes to transaction data whenever you want and feel like it.

3. Where Can I Configure My Budget Limits?

All budget limits will be set based on category. For example, you can adjust them in the property dialog of the chosen category and then start budgeting.

4. What is the best way to transfer AceMoney and data from one computer to another?

You can easily share files from one computer to the other using the brand new AMJ format. This format works if only the user where the file was initially created is permitted for this sharing to take place.

You can give permission by clicking on ‘Tools,’ then select ‘options,’ afterward click on ‘password.’ Once you have done all this, mark the ‘allow multi-user access’ box and choose a password.

Users who know the password can access the files, which offers additional protection. All you need to do to move AceMoney and data from one computer to another is to do the following:

- Run backup procedures and move the AMJ file to the other computer

- Uninstall the AceMoney software from the previous (the old) computer

- Now, install the new version of the software on your new computer

- You need to enter the serial number that AceMoney has sent you via email

- Open the older data file and select the box titled ‘load the last file during startup.’

That is all you need to do to move AceMoney and data from one computer to another.

For your information, the older version of AceMoney asks for no password, and you won’t be able to find a sharing option either with this version.