24/7 Loan Pros is one of several loan aggregators available for customers wanting to shop for loans. Essentially, the company buys mortgages from lending services and turns them into Mortgage-Backed Securities (MBSs).

However, what distinguishes 24/7 Loan Pros from other lending services is that it connects you to network funding online, making it easier to access decent loans via one simple application.

Before we take a step further and go into more in-depth information in this 24/7 Loan Pros review, let us give you a complete overview of everything we will elaborate on.

Contents:

- 24/7 Loan Pros Highlights

- 24/7 Loan Pros Requirements

- 24/7 Loan Pros Loan Terms

- How to Apply for a 24/7 Loan Pros loan?

- Who is 24/7 Loan Pros Best For?

- What Credit Scores Range 24/7 Loan Pros Is Good For?

- 24/7 Loan Pros Rating and Accreditation

- Pros and Cons

- 24/7 Loan Pros Alternatives

- 24/7 Loan Pros vs. Even Financial

- 24/7 Loan Pros vs. ZippyLoan

- Conclusion

- FAQs

24/7 Loan Pros Highlights

As we already mentioned, 24/7 Loan Pros is a loan aggregator that provides people loans through network funding. In this network funding mortgage loan service, people receive minor to midsize mortgage loans.

To put it simply, 24/7 Loan Pros-only behaves like an impartial mortgage matching service, connecting both private mortgage and supported lenders with customers seeking loans online. It is different from lending agents, direct lenders, and brokerages as it allows borrowers to get extra aggressive mortgage earnings.

How does 24/7 Loan Pros do that?

24/7 Loan Pros does this by sharing your details to a network of lenders, helping you get higher mortgage approval charges as a result. In other words, as a borrower, you could connect with lenders despite having low credit scores and instead create a new credit history for your loans.

What makes 24/7 Loan Pros different and special among others in this business?

What separates 24/7 Loan Pros network funding from other services is that it offers greater flexibility. This means that you don’t have to provide detailed reasons for personal loans.

What are 24/7 Loan Pros fees?

For all its services, 24/7 Loan Pros charges you an undisclosed fee based on the size of your loan, aside from the one percent origination fees. You can learn about these charges by asking for a quote on their official website.

Most importantly, if several lenders accredit your mortgage request, they will decide the circumstances around the mortgage earnings. If any of those lenders approve your mortgage request, they quickly sign off the mortgage settlement electronically. 24/7 Loan Pros offer simple, fast loans. Therefore, you will receive the requested mortgage funds within twenty-four to seventy-two hours.

In case your mortgage request is denied by the creditors, you will be given several alternative options to choose from. Although 24/7 Loan Pros claim that you can contact potential lenders despite having bad credit, 24/7 Loan Pros reviews denote that your application has greater odds of being accepted by the lending network if you have a good credit history.

Overall, 24/7 Loan Pros is an excellent way to receive unsecured personal loans for fair credit, as well as no credit check loans.

Are there any APR (Annual Percentage Rate) caps with 24/7 Loan Pros?

Yes, there are APR caps even with 24/7 Loan Pros. However, the interest rate is not as extremely high as opposed to other small loan providers. Although the interest rate will mostly depend on your lending network, you can still get an APR range roughly between 5.99% and 35.99%.

What are the loan limits that come with 24/7 Loan Pros?

Their loan offers range from $100-$35.000, allowing you to cash a decent loan with an easy-to-follow online process. Besides that, you can ask for $30.000 to $35.000 mortgage loans maximum. Although, it is good to know that not all of those who’ll ask for the maximum of $35.000 will also be granted the same. Meaning, not necessarily all borrowers qualify for the highest loan possible.

What kind of credit score do I need to have so as to use 24/7 Loan Pros lending services?

Following the 24/7 Loan Pros regulations, your credit score should be above 540 to be eligible to use their lending services.

What is the repayment period with 24/7 Loan Pros?

As we said already, 24/7 Loan Pros assist you in finding the best suitable lender for your needs. Thus, they are not included or aware of the further terms and agreements you will undergo with the loan company you’ll choose at the end of the process. In other words, the repayment terms would be assigned from the lending company you’ll decide to carry on.

In addition to this, as we mentioned earlier before, the APR caps won’t succeed more than 35.99% and won’t go below 5.99% either. As far as the personal loans go, you have a sixty-one-day minimum repayment period and a maximum of seventy-two months repayment period too.

Our suggestion for you would be to pay close attention to all of the terms provided in the agreements offered by the lender before signing anything.

Moreover, here are some numbers that can serve you as a good example of APR, loan fees and costs, repayments, etc. Check out the following table:

24/7 Loan Pros Requirements

How Do I Qualify for 24/7 Loan Pros? What are their requirements?

24/7 Loan Pros is an incredibly robust loan distribution service. It connects you with several lending partners, helping you choose the loan type of your choice. From 24 7 payday loans, personal loan pro, and fast loan direct plans, 24/7 Loan Pros offers many plans. But, first things first, you need to check whether you’re eligible for it.

As everywhere else, here too, to be eligible to request a loan, you have to be 18 years old, an American citizen, or at least have a document stating you’re a permanent resident. Following that, you must have a minimum income of $800. And in addition to this, you’ll have to show proof of a present and confirmable income, alongside also a confirmable bank account.

The next thing to do is to permit 24/7 Loan Pros to verify your employment. At the same time, you must give a valid current or savings account for processing all your payments. Lastly, you have to provide essential details such as your home address, telephone number, and email address. You must ensure that all these details are valid and connected to yourself.

Like other loan providers, 24/7 Loan Pros makes it mandatory for borrowers to surpass a minimum 540 FICO score.

NB: Unfortunately, you will not be eligible for a loan if you are currently serving in the military.

24/7 Loan Pros Loan Terms

24/7 Loan Pros offers you personal loan pro plans starting from 2 months to a maximum of 3 years. Your starting amount can be from simply $100 to $35.000 based on your loan type, credit scores, and the state you’re living in.

The interest rate can also vary from 5.99% to 35.99% based on the same conditions (we’ve already mentioned this).

How to Apply for a loan through 24/7 Loan Pros?

It’s a straightforward process that won’t take more than much of your time. Moreover, 24/7 Loan Pros will quickly process your application, enabling you to get cash in hand within one to three business days. Once a lender accepts your application, the platform will transfer your amount directly into your bank account.

Anyway, let us explain the process step by step and make it a lot easier for you:

Step 1: First, visit the website and click on the ‘Get Started Now’ button to get a quote for the amount you want to request.

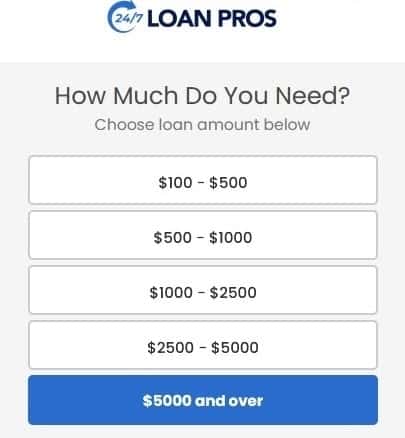

Step 2: You will be asked to choose one of the following amounts:

Step 3: Once you choose the desired amount, you will be asked to provide your personal information, such as name and last name, followed by a legit email address.

Step 4: Once you submit the online application successfully, 24/7 Loan Pros will forward your request to its network of lenders, who will compete with each other and bid the best deal between themselves.

Step 5: The lenders will then present you with several offers that you can choose at your discretion based on who offers the best terms.

Step 6: Now, you only have to sign the document electronically with the lender that you choose. Once you do that, the requested loan amount will be deposited into your account.

The application process will consist of a good number of pages. Although the application process is time-consuming, in the end, you will be able to choose which lender has the most suitable loan arrangements for you.

Who is 24/7 Loan Pros Best For?

24/7 Loan Pros is excellent for people with low credit scores and who want personal loans in exchange for mortgage requests. 247fastfunds enables you to acquire the money you need immediately. You can also access installment loans online, fast loan direct, and quick funding loans. Not to mention the convenience of comparing rates among different lenders without sending separate applications.

Is my data safe?

Following what has been stated on their website, the company provides encrypted data protection, following all industry regulations. Therefore, you shouldn’t torment yourself with their safety regulations or potential risk levels when you leave your information with them. Even better, 24/7 Loan Pros doesn’t give out any data to third-party lenders who have no connections to the site whatsoever.

What States Is It Good For?

24/7 Loan Pros works for all the other US states, except the following:

- New York,

- Vermont,

- West Virginia,

- and Arkansas.

24/7 Loan Pros Rating and Accreditation

We have to admit there wasn’t much to find regarding this section. However, we did manage to come across some interesting information for you. Let’s start with some ratings from lending review platforms.

- Mr. Credit Card: This loan review platform gave it a 3.4 star-rating/5. This kind of rating is still a positive one and worthy of being mentioned.

- Review Crest: 24/7 Loan Pros received 2.1 star-rating/5 from this review platform.

- BBB (Better Business Bureau): Unfortunately, we weren’t able to find any reviews, ratings, or accreditation on the BBB regarding this company.

Pros and Cons

Pros

- Wide range of loan amounts from $100 to $35.000.

- Minimum of 540 credit score.

- Fast processing time.

- Several plans.

Cons

- No good for those in the active military.

- Do not accept benefits as income.

- Limited state availability.

24/7 Loan Pros Alternatives

24/7 Loan Pros vs. Even Financial

Even Financial is an efficient and excellent online platform that offers great personal loan services. It helps you connect with several reputable lenders across the United States. Most importantly, the application process is easy and convenient, and you don’t have to go through several pages for the application.

One of the most significant differences between 24/7 Loan Pros and Even Financial is the limited loan you can take. Therefore, Even Financial offers a maximum of $100.000, opposed to 24/7 Loan Pros $35.000. However, 24/7 Loan Pros lets you make a loan of at least $100, while Even the Financial minimum loan starts from $1.000.

Otherwise, both of these platforms work pretty much in the same way. They are mediators between you and any of their vast networks of lenders. Afterward, the agreements and conditions depend on you and your lender solely.

24/7 Loan Pros vs. ZippyLoan

Again, both 24/7 Loan Pros and ZippyLoan help you find the best lender that can help you get the loan you need. As much as their service is the same, or better yet similar, there are still some differences.

One striking difference is the limit of the loan you can request for. With 24/7 Loan Pros, you can take up to $35.000, while with ZippyLoan, the maximum is only $15.000.

However, ZippyLoan, on the other hand, has a broader state availability, with the only exception being the state of New York. As you have already read in this review, 24/7 Loan Pros doesn’t consider the people serving actively in the military eligible for a loan through them. On the other hand, you won’t have any problems if you decide to go via ZippyLoan, since they don’t share the same opinion with 24/7 Loan Pros.

Another striking difference and of importance to you is the credit score limit. With ZippyLoan, you are not asked for a credit score whatsoever. But, if you want this done via 24/7 Loan Pros, you will have to show a credit score of at least 540.

Conclusion

This 24/7 Loan Pros review clearly shows that they are more than just a convenient service for acquiring quick and convenient loans immediately. That being said, if you do qualify according to specific requirements, they have aligned, like your credit score to exceed 540, and also for you not to be in the military. Additionally, It offers a great platform to acquire loans in exchange for mortgage requests.

Moreover, 24/7 Loan Pros gives you an active group of lenders willing to give you loans for reasonable interest rates. So, if you need a conventional loan and don’t really fit most bank’s requirements, this is your go-to money loan service. 24/7 Loan Pros will make sure to connect you with the most suitable lender according to your status and needs.

FAQ

1. Is 24/7 Loan Pros legit?

24/7 Loan Pros is a legitimate loan aggregate platform where lenders can issue mortgage requests to a network of lenders. As far as this goes, they consider the fact these loans should be convenient and fast. One of the perks in going for it through them is the network of lenders they have to offer you – lenders that come with many different loan processing methods and agreements.

2. What can I use my 24/7 Loan Pros loan for?

The loan you get from 24/7 Loan Pros can be used for your personal needs and goals. Whether that be paying off a mortgage on your house, or some costly car repairs, maybe you just want to afford that long-wished-for vacation destination—all the money you’ll get as a loan is entirely up to you how and where you will spend it.